Fake Tax Id Number Us

2024-05-06 2024-05-06 9:16Fake Tax Id Number Us

Fake Tax Id Number Us

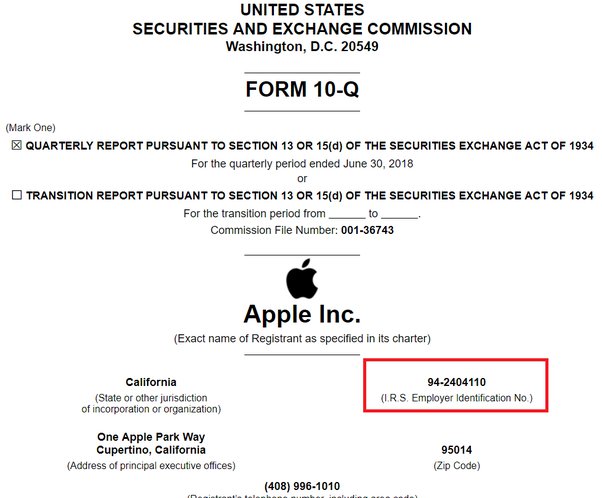

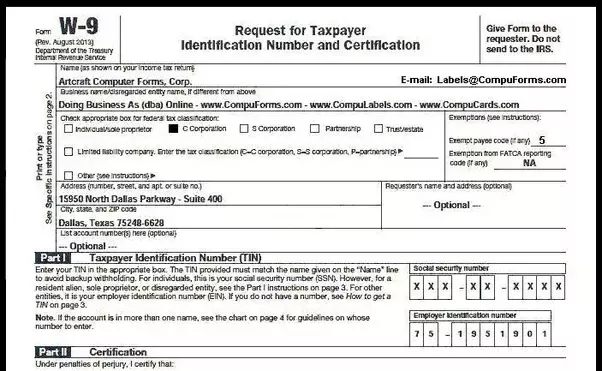

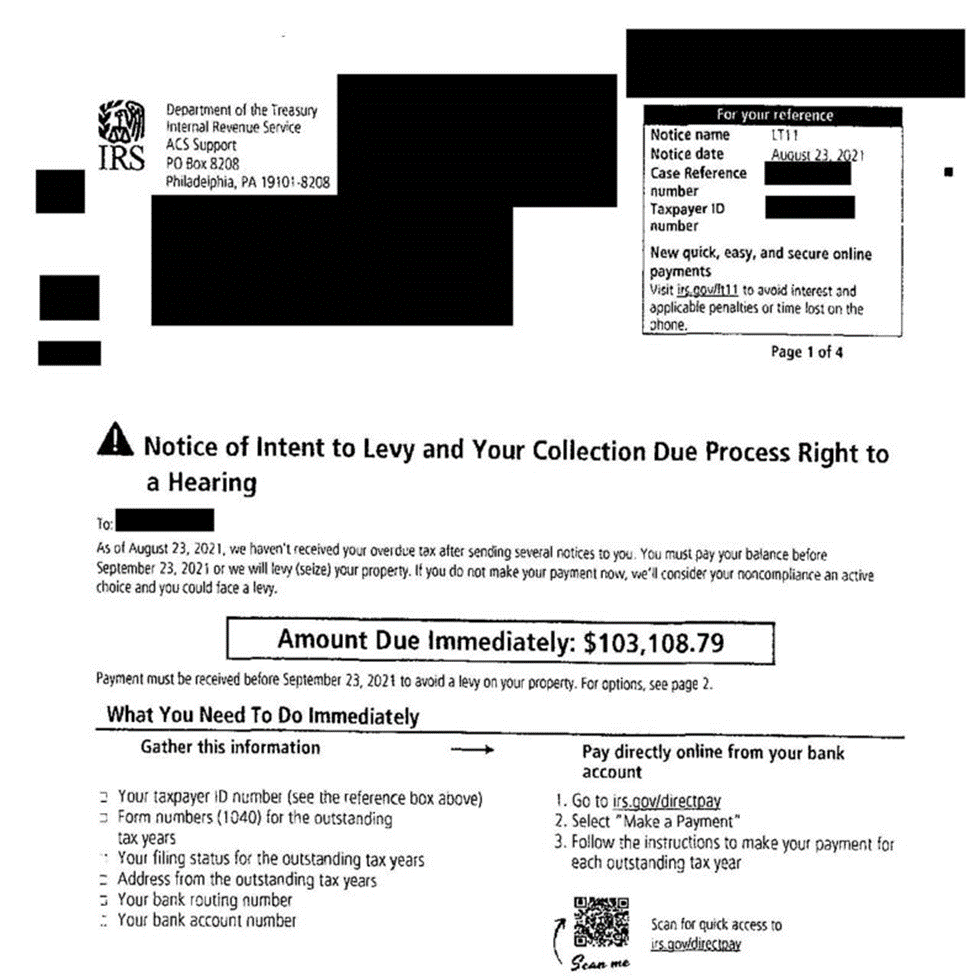

When it comes to obtaining a fake tax ID number in the US, it is crucial to be cautious and wary of the consequences that may arise from using fraudulent information. A tax ID number, also known as an Employer Identification Number (EIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses and other entities for tax purposes. While it is illegal to use a fake or invalid tax ID number, there are still individuals who attempt to do so for various reasons.

One common reason why individuals might seek to obtain a fake tax ID number is to evade paying taxes. By using a fake EIN, individuals can avoid having their income reported to the IRS, thereby escaping tax obligations. This can lead to serious legal repercussions, including fines, penalties, and even criminal charges. As such, it is highly advisable to refrain from engaging in any activities that involve the use of a fake tax ID number.

Another reason why individuals may be tempted to use a fake tax ID number is to gain access to certain benefits or services that require a valid EIN. For instance, some financial institutions may require an EIN to open a business account or apply for business loans. By providing a fake tax ID number, individuals may attempt to deceive these institutions into providing them with services or benefits that they would not otherwise be eligible for. However, this practice is illegal and unethical, and can result in serious consequences if discovered.

In addition to the legal ramifications of using a fake tax ID number, there are also ethical considerations to take into account. By using fraudulent information to obtain financial benefits or avoid tax obligations, individuals are essentially engaging in deceitful and dishonest behavior. This not only goes against the principles of integrity and honesty, but can also harm other individuals or entities who may be affected by the individual’s actions.

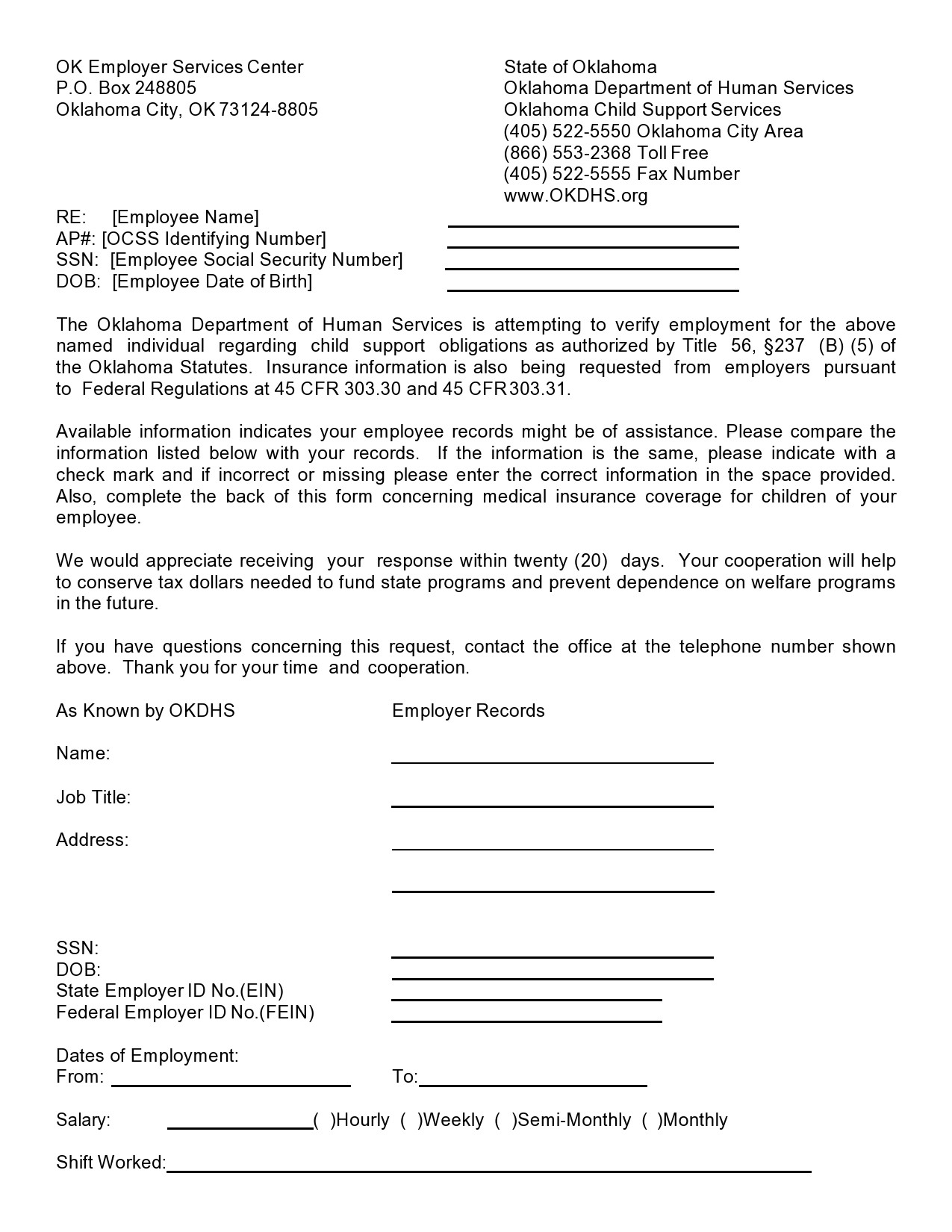

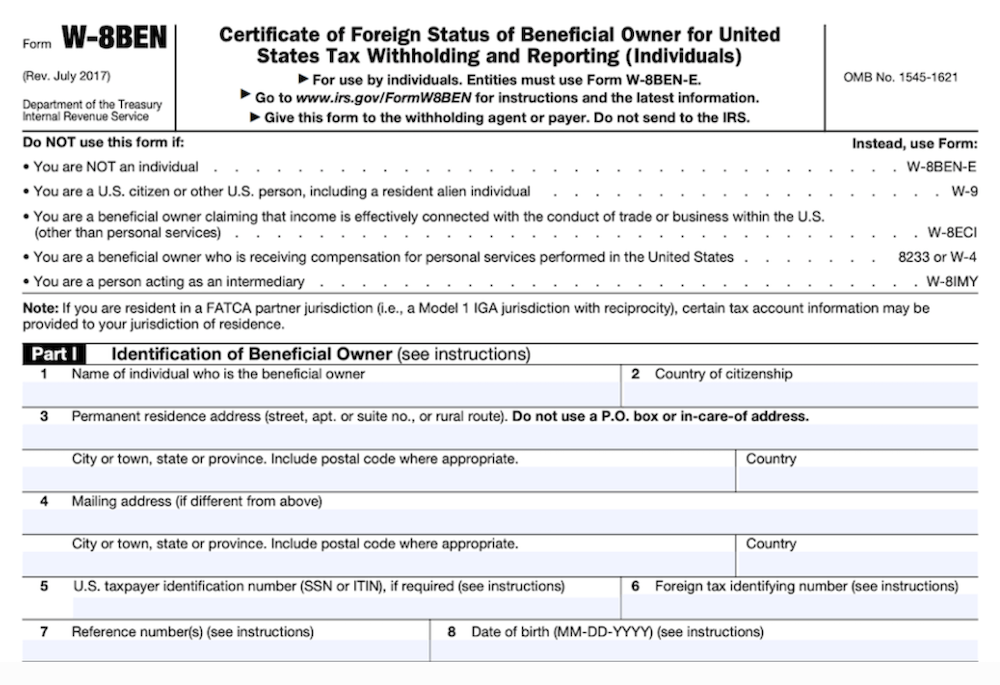

It is important to recognize that there are legitimate ways to obtain a tax ID number in the US. For businesses, the process typically involves applying for an EIN directly through the IRS. The application can be completed online, by mail, or by fax, and requires basic information about the business, such as its name, address, and type of business entity. Once approved, the IRS will assign a unique EIN to the business, which can be used for tax-related purposes.

For individuals who are not business owners but require a tax ID number for other purposes, such as opening a bank account or applying for a loan, there are alternative options available. Some financial institutions may accept a Social Security number (SSN) in place of an EIN for certain transactions. Additionally, there are legitimate third-party services that can help individuals obtain a tax ID number legally and ethically.

In conclusion, the use of a fake tax ID number in the US is not only illegal but also unethical. Individuals who are caught using fraudulent information to obtain financial benefits or avoid tax obligations can face serious consequences, including fines, penalties, and criminal charges. It is important to prioritize honesty and integrity in all financial transactions and to seek legitimate means of obtaining a tax ID number when necessary.